Patent case numbers rising at UK High Court

The number of newly filed patent cases at the UK High Court rose by over 30% during 2023, after an all-time-low in the previous year. In addition, the UK judiciary introduced a new cost-cap system in early 2024, which aims to appeal to mid-tier litigants.

19 March 2024 by Konstanze Richter

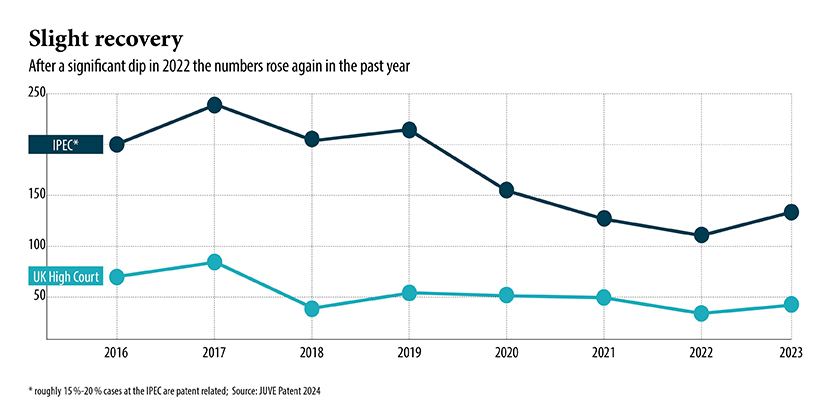

According to civil justice statistics, the number of new patent cases which parties are filing at the first-instance UK High Court are rising once again. In 2023, parties filed 46 new patent actions. This is a 31.4% increase compared to the previous year; in 2022, companies filed only 35 new lawsuits.

Patent cases rise

However, the majority of the new law suits accumulated in the second half of 2023. While companies filed 17 patent cases between January and June, they filed a total of 29 new lawsuits in the time intervening time from July to December.

Since a historic drop in 2022, the number of patent cases parties are filing at the UK High Courts is rising once again.

The most important newly filed lawsuits again include FRAND disputes such as Lenovo vs. Ericsson and Panasonic vs. Oppo and Xiaomi, with the latter now reaching the UPC on the continent.

At the same time, the UK High Court also handed down important judgments in important SEP battles such as InterDigital vs. Lenovo and Apple vs. Optis. The courts were also busy with medical device and pharmaceutical suits. Of these, stand-out cases include developments in Dexcom vs. Abbott over continuous glucose monitoring (CGM) devices, Advanced Bionics vs. Med-El over cochlear implants, and Astellas vs. Teva over treatment for overactive bladders.

A variety of claimants

Interestingly, the claimant sources also present a mixed picture. At the UK High Court, 12 claimants filing suits at the UK High Court comprised a mixture of UK- and non-EU-based companies, followed closely by ten parties which comprised a mix of UK, EU and non-EU-based companies. Just six claimants were made up of entirely UK-registered companies, while four claimants were a mixture of UK and EU-based companies.

Overall, just three parties comprised a mixture of EU and non-EU members, with no UK-registered companies involved in these proceedings.

IPEC sees uptick

The Intellectual Property Enterprise Court (IPEC), a specialist subdivision within the Business and Property Courts of the UK High Court, has also published figures which reflect this upwards trend. Over the past 12 months, the total number of new IP cases came to 132, an increase of 17.8% compared to the previous year. In 2022, however, the IPEC counted only 112 new cases.

Regarding claimant provenance, the picture is vastly different to the parties filing cases at the high court. At 67, the vast majority of parties filing claims at the IPEC were UK-based, while 27 claimants were comprised of UK- and non-EU-based parties. Finally, 13 were a mix of UK and EU. Just five parties based entirely outside of the UK filed IPEC cases over 2023.

The IPEC hears patent disputes of small and medium-sized companies, which observers often consider to be of minor economic importance. Experts estimate that typically 15% to 20% of IPEC cases concern patents, while the rest involve soft IP such as trademarks, design or copyright.

Cost-cap introduced

IPEC proceedings are subject to a financial limit of £60,000 in costs and around £500,000 in damages, while costs for proceedings in big patent battles at the UK patent courts can reach the several millions.

For patent disputes which are typically less complex than those the patent court usually hears, but more complex and higher stakes than an IPEC case, the UK judiciary recently introduced a new cost-cap system within the Shorter Trial Scheme (STS).

The new system, which caps costs at £500,000 and has no limit on damages, is particularly suitable for mid-tier cases. It also provides potential litigants with greater certainty about the total financial risk of commencing proceedings.

Tried and tested

Prior to the introduction, the courts have already successfully applied the STS in patent cases. This includes Facebook against Voxer and Insulet against Roche Diabetes Care. The Intellectual Property Lawyers Association (IPLA), which supported the development, based its cost-cap calculations on some judgments and orders that provided information about costs recovery in patent claims brought under the STS.

For example, these included Insulet against Roche (2021), Permavent against Anor (2020) and a previous decision in Advanced Bionics against Med-El (2022). (co-author: Amy Sandys)